Competitors present a major obstacle between a company and its targeted customer segments. In a competitor analysis, the relevant competitors have to be identified, analysed and compared with the own company. Competitors can either be direct competition when providing the same products and services or indirect competition, when they satisfy the same customer needs via different products and services. Data on these direct and indirect competitors can be gathered via a multitude of channels and be analysed on specific factors which are important to the respective market. The competitors’ Key Competitive Factors (KCF) can be concluded from this data analysis and be compared to the own company’s KCFs which have been identified in 'Company Description'.

After drawing conclusions on the company’s character in Company Description and the targeted market and customer segments in Market Analysis, the company’s competitors have to be analysed as they present a major obstacle between a company and its targeted market. A competitor analysis is a process comprised of the identification of competitors, the gathering of data, the analysis of gathered data and the comparison of competitors to the own company.

Competitors are other companies or organisations that solve the same problem for the customers as the own company does. One can distinguish direct competitors, i.e. companies that offer the same or a comparable product and indirect competitors, i.e. companies that satisfy the same need but through a different product or service (SAAS NO YEAR). For example, if a company offers to drill boreholes for customers to gain access to groundwater sources, its direct competitors are obviously other borehole drilling companies. However, the customer need for access to water can also be satisfied by companies that offer installation of water tanks or rainwater harvesting devices. These companies then represent indirect competitors to the borehole drilling company. You will also want to include information on companies that may be entering your market in the coming year (KNOWLES, 2002).

When gathering data, one does not have to act unethically, as most of the information on competitors is readily available via open sources. The webpages of competitors are a good first step to get to know them. Furthermore, annual reports, trade magazines, or industry publications on individual competitors as well as the entire industry are good sources (CPSA NO YEAR). Conferences, seminars and trade shows are forums to get into more direct interaction with actors in a given industry (CPSA NO YEAR). In addition, customers and partners of competitors might be willing to share information.

Questions that can be answered during the analysis of the gathered data are:

- Who are the direct competitors?

- Who are the indirect competitors? What substitute products or services exist in the market?

- What are their strengths and weaknesses?

- What are their prices?

- Where are they located?

- What are their value propositions?

- How is their quality?

- What is their reputation?

- What distinctive competencies and experiences do they have?

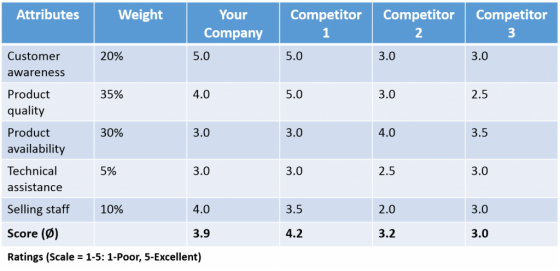

Once sufficient data is gathered and analysed, a company can compare itself with its competitors. Here, the Key Competitive Factors (KCF) which were introduced in Company Description come into play again. These KCFs are specific to the market in which the company wants to be established. It is not only important to design the own company’s KCFs but also to be aware of the competitors KCFs. These explain the respective competitor’s relative success in the market. Examples for possible KCFs are:

- Reputation

- Cost per unit

- Experience

- Brand

- Relationships

- Staff skills

- Customer services

- Product quality

Example of a competitor analysis. Source: Own illustration, adapted from SMARTDRAW (NO YEAR)

Competitor Analysis Outline

This document provides a brief guideline on competitive analysis, including possible criteria and scoring keys.

CPSA (n.y): Competitor Analysis Outline. Canadian Professional Sales Association (CPSA) URL [Accessed: 16.12.2015]How to Write a Competitive Analysis

Competitive Analysis

A guideline on how to conduct a competitors analysis.

SAASNET (n.y): Competitive Analysis. Understanding Your Competition. State Association of Addiction Services (SAAS) URL [Accessed: 16.12.2015]Competitor Analysis Outline

This document provides a brief guideline on competitive analysis, including possible criteria and scoring keys.

CPSA (n.y): Competitor Analysis Outline. Canadian Professional Sales Association (CPSA) URL [Accessed: 16.12.2015]How to Do an Industry and Competitive Analysis

An introductory presentation on industry and competitive analysis.

HOLMS, A. (n.y): How to Do an Industry and Competitive Analysis. UCSB Writing Program and College of Engineering URL [Accessed: 16.12.2015]Competitive Analysis

A guideline on how to conduct a competitors analysis.

SAASNET (n.y): Competitive Analysis. Understanding Your Competition. State Association of Addiction Services (SAAS) URL [Accessed: 16.12.2015]http://www.netmba.com

Webpage which gives a guideline on competitor analysis, including a framework by Michael E. Porter.