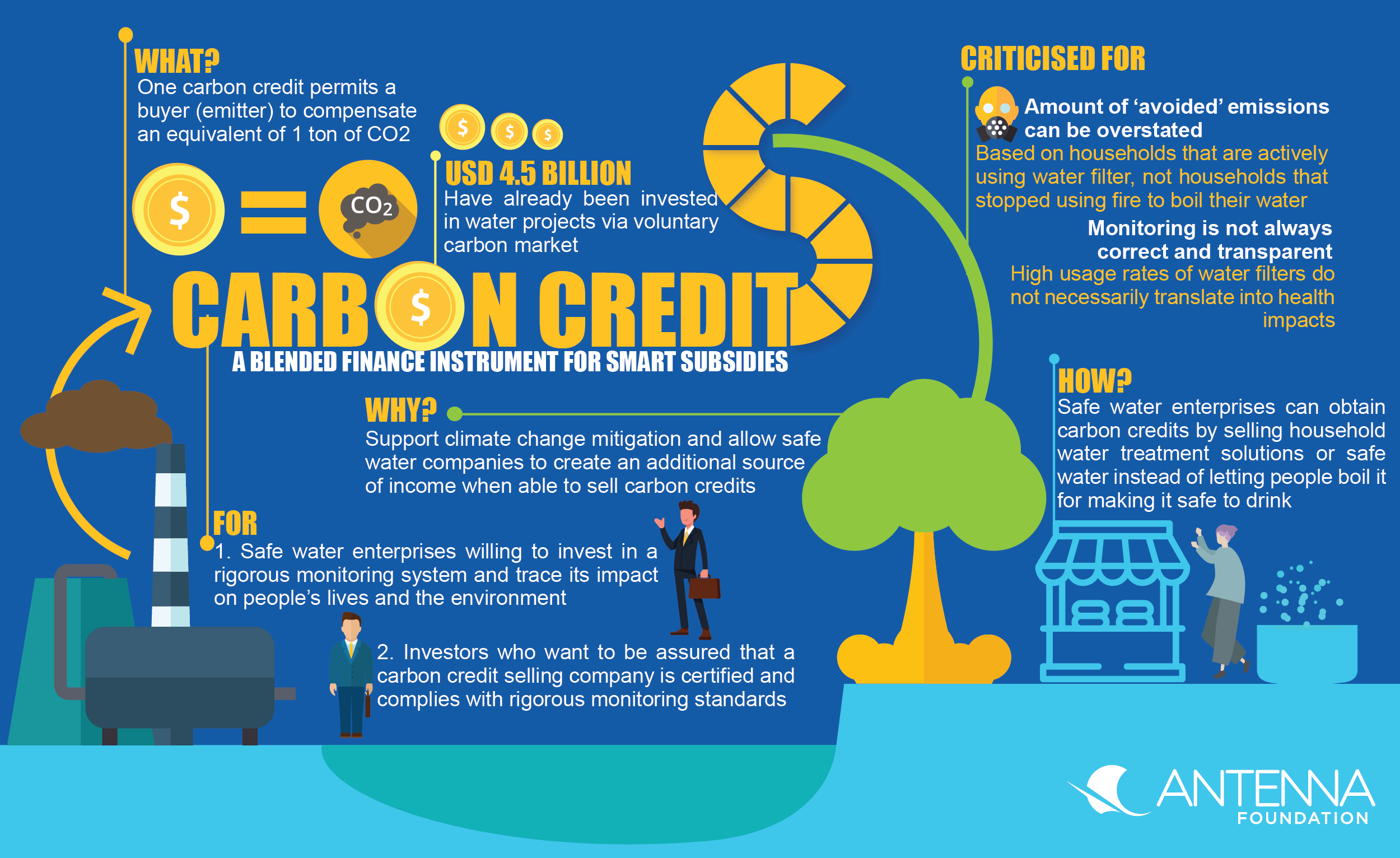

Carbon credits are a tradable commodity that allows an emitter to compensate carbon emissions equivalent to 1 ton of carbon dioxide (CO2). Safe water enterprises can obtain carbon credits by monitoring and certifying the positive environmental impact of a safe water project in terms of CO2 reduction by using a household water treatment solution (HWTS) or selling safe water instead of boiling to make water safe to drink.

This factsheet about carbon credits provides the reader with a distinction of “official” and “voluntary” carbon credits and what steps have to be pursued in order to obtain carbon credits and sell it on the voluntary carbon market to generate an additional income stream.

The case study about Hydrologic in Cambodia provides various insights on the procedure of certifying and monitoring the CO2 reduction within a for-profit safe water project.

Carbon credits are a market-based method and tradable commodity to compensate carbon emissions and are traded on different carbon markets. Specifically have carbon finance and carbon credit systems been introduced to permit emitters (polluting countries, industries, companies or individuals) compensate their (over-)emission and/ or mitigate climate change. One carbon credit permits a buyer (emitter) to emit an equivalent of 1 ton of CO2. About USD 4.5 billion have already been invested in water projects via the voluntary carbon market (HAMRICK & GOLDSTEIN, 2015). These credits are created through certified innovative projects (e.g. Hydrologic in Cambodia) and traded in different voluntary carbon markets. The voluntary carbon schemes are different from the “official” carbon market, which is linked to the official compliance schemes under the Kyoto Protocol where states ratified certain levels of emissions that should not be surpassed (CLIMATECORPORATION, n.y.; HAMRICK & GOLDSTEIN, 2016). The carbon credits of the official carbon market are created through projects that are nationally approved and have undergone the verification and registration process of the UNFCCC (United Nations Framework Convention on Climate Change). Both schemes have been created in an attempt to sustainably mitigate greenhouse gas emissions (such as CO2) globally. For more information please visit Climatecorp or Carbon Solutions Global.

Carbon credits do support climate change mitigation and allow safe water companies to create an additional source of income when able to sell carbon credits. The additional income can be used as smart subsidies to cover CapEx, social marketing activities etc. and will sustainably support the viability of a safe water company.

But there is also criticism on water carbon projects:

Carbon credit mechanisms for water in general have been criticised by a number of people (PICKERING ET AL., 2016; STARR, 2011; YEO, 2013). Two main points that are mentioned are:

- Monitoring is not always correct and transparent. Health benefits can be overstated, for instance when filter usage is being used as indicator for health impact, while high usage rates do not necessarily translate into health impacts (YEO, 2013). Also measuring ‘usage’ does not always happen correctly. Carbon offset program implementers are now allowed to collect their own monitoring data to determine the number of carbon credits to be awarded. A survey about HWTS in Kenya by Stanford University found that household water filters usage rate (i.e. 19%) that was much lower than the internal monitoring program reported (i.e. 81%). The authors recommended that independent monitoring should be a key requirement for carbon credit verification (PICKERING ET AL., 2016).

- Amount of ‘avoided’ emissions can be overstated. Many projects are based on the principle of “suppressed demand”, which means that avoided future emissions are the same as reduced current emissions. It assumes that i) people would meet the minimum service level for water if the resource was available and ii) the next logical technological step would be to boil their water (GOLD STANDARD, 2016). This suppressed demand methodology bases its calculations on households that are actively using the water filter, rather than households that have stopped using fires to boil their water. So a baseline can include carbon emissions theoretically emitted from households that would boil their drinking water if they had access to sufficient fuel and the resources to obtain it (independent of whether households currently actually boil their water). Critics note that in many cases households don’t actually or would not intend to boil their water in the absence of the project (YEO, 2013; STARR, 2011).

Subscribe here to the new Sanitation and Water Entrepreneurship Pact (SWEP) newsletter. SWEP is a network of organizations joining hands to help entrepreneurs design and develop lasting water and sanitation businesses.

Carbon credits are interesting for safe water enterprises that are willing to invest in a rigorous monitoring system and trace its impact on people’s lives and the environment. In the long-term the sales of carbon credits will help a safe water company to have a steady income stream for subsidizing company activities and/or expansion.

Carbon credit accredited safe water companies have also an advantage to show a mature level of monitoring to investors. Investors on the other hand are assured that a carbon credit selling company is certified and complies with rigorous monitoring standards.

To sell carbon credits on the voluntary market, a project needs to be certified by an international certification body, like the Gold Standard or VCS Standard among others. This requires an extensive monitoring process in which an enterprise proofs and quantifies how many tons of CO2 have been reduced by a specific project through the use of water filters, chlorine and other HWTS in comparison to make water safe for drinking through boiling (e.g. on a fire) (SUMMERS ET AL., 2015).

The case study from Hydrologic in Cambodia provides various insights on the procedure of certifying and monitoring the CO2 reduction within a for-profit safe water project.

Emissions trading news and the voluntary carbon

About Gold Standard

Ahead of the Curve - State of the Voluntary Carbon Markets 2015

Raising Ambition - State of the Voluntary Carbon Markets 2016

Climate and Health Co-Benefits in Low-Income Countries: A Case Study of Carbon Financed Water Filters in Kenya and a Call for Independent Monitoring

Thirty Million Dollars, a Little Bit of Carbon, and a Lot of Hot Air

CO2 and H2O: Understanding Different Stakeholder Perspectives on the Use of Carbon Credits to Finance Household Water Treatment Projects

Towards more responsible carbon finance for water

Carbon finance: unlocking investments for safe water?

Winners of Environmental Finance's Voluntary Carbon Market Rankings see lower prices but remain bullish

Article provides interesting overview of different environmental-friendly financing instruments and organisations engaged with it.

ENVIRONMENTAL FINANCE (EDITOR) (2016): Winners of Environmental Finance's Voluntary Carbon Market Rankings see lower prices but remain bullish. URL [Accessed: 20.04.2018]