Blended finance or hybrid finance stands for mixing public and/or philanthropic funding with market based funds (loans, grants or equity) for creating mature social businesses and NGOs. Blended finance helps making social enterprises investible and thereby unlock impact investment on a much more significant scale by e.g. mitigating the risk of a market based investment as the public funder carries parts of the investment risk (de-risking).

This factsheet provides the reader with an overview of the concept of blended finance. It presents how investors and public funders can practically use blended finance and how safe water enterprises can access it. Additionally a variety of blended finance instruments and institutions that do offer such instruments are described. The Social Impact Incentive concept offers a practical example of how blended finance can be implemented in practice.

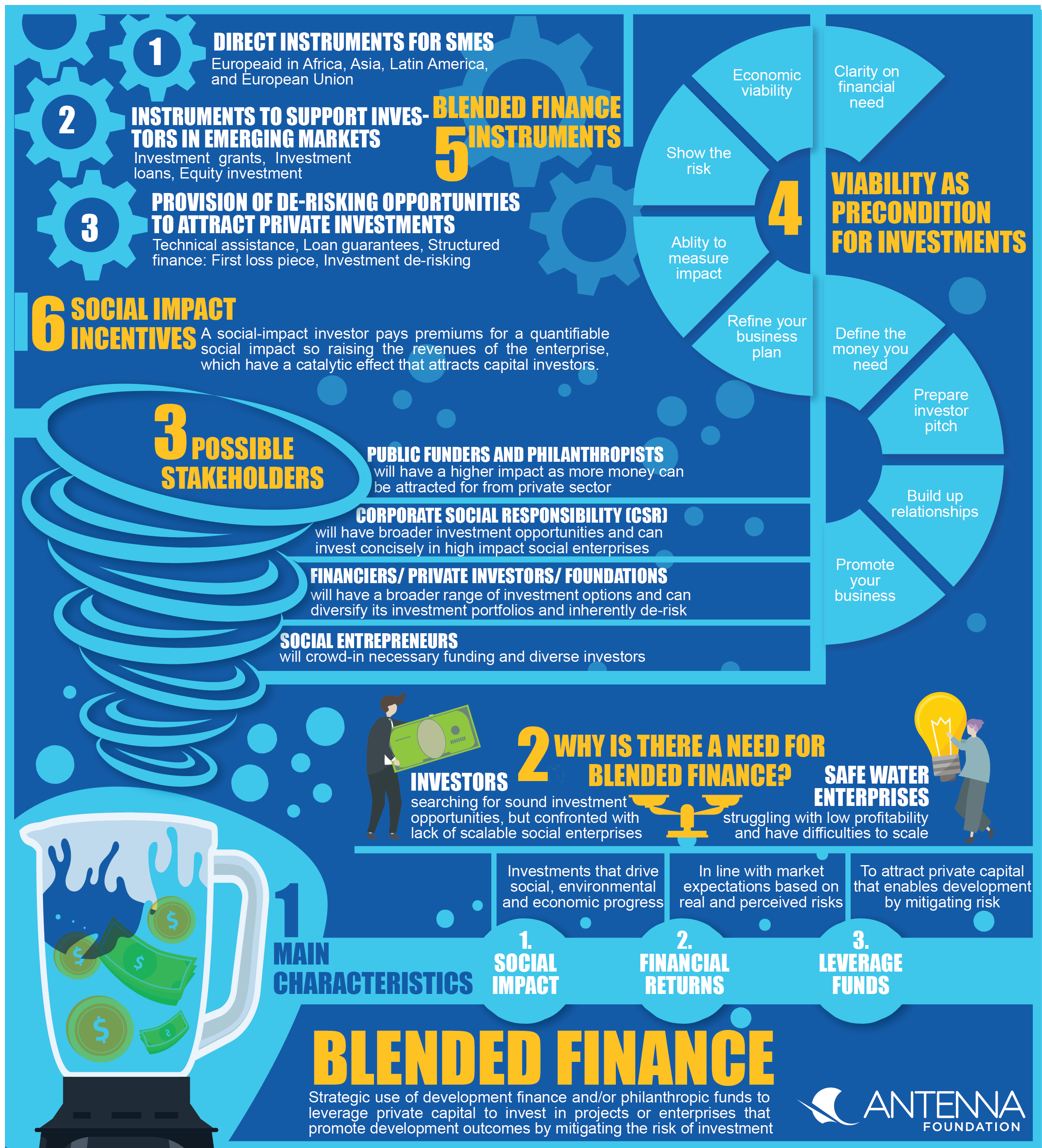

Blended finance is defined as: Strategic use of development finance and/or philanthropic funds to leverage private capital to invest in projects or enterprises that promote development outcomes by mitigating the risk of investment (de-risking) (WEF, 2015).

This definition can be boiled down to 3 main characteristics of blended finance:

- Social impact: Investments that drive social, environmental and economic progress.

- Financial returns: Financial returns for private investors in line with market expectations based on real and perceived risks.

- Leverage: Use of development finance and philanthropic funds to attract private capital into projects that enable development and philanthropic funding by mitigating risk and/ or ensuring commercial risk adjusted returns.

The goal of blended finance is to lead to increased viability and impact of social businesses, also in the water sector.

For further information on the definition of blended finance, please have a look at WEF (2015) and PPPlab publications from Aqua for All.

Many social enterprises and safe water enterprises in particular are struggling with low profitability, have difficulties to reach scale and are confronted with an array of other problems, such as a near universal lack of access to finance (WEF, 2015). At the same time, for many (social impact) investors, there is a “lack of high-quality investment opportunities with track record” (GIIN, 2016). Meaning numerous investors are searching for sound investment opportunities, but are confronted with a lack of scalable social enterprises in which they could invest. Reasons why are too high-risk perceptions, lack of monitoring but also visibility of social safe water enterprises. Market-based solutions to create access to safe drinking water for the poor reflect a high-impact investment opportunity. But too often the capital to penetrate the market and reach profitability is lacking (WEF, 2017). Recent discussions in philanthropy and development finance promote blended finance to match this gap by mobilizing private money via different means to combine it with grant funding. As many safe water programs are either not fully profitable or cannot cover all the costs of market creation and social marketing, such types of blended finance may be the solution. There are already many existing innovative mechanisms created and tested in the last few years. Though more innovative approaches and out-of-the-box thinking will be needed in order to reach people with safe water around the globe. New pragmatic solutions are required that turn the old way of pure grant-financed - and often not sustainable - operations into more and more viable business models. The solutions may not be black or white, but rather grey shades: scaling-up safe water for the BoP might neither be a bucket with a hole nor a highly profitable business. The right solution is finding a way to mix or blend grants and market based finance: blended or hybrid finance.

The concept of blended finance is attractive for public funders, philanthropists, financiers as well as social entrepreneurs and national economies as such.

The figure above shows that blended finance can support the growth of sectors through making enterprises or projects investible, which attracts further investments within the sector and facilitates real market creation. Blended finance can thus involve a multitude of stakeholders and is attractive and interesting for:

- Public funders and philanthropists will have a higher impact with their specific funding as more money can be attracted for a specific project from the private sector. A necessity is to see de-risking as a valid option (de-risking can include paying for market trials, partial credit guarantee, up-front investment subsidies, shaping regulations and laws, covering the high-risk investments etc. to make investment options for private money more attractive).

- Corporate Social Responsibility (CSR) departments of companies have broader investment opportunities and can invest concisely in high impact social enterprises. With the approach of blended finance social enterprises can directly be approached.

- Financiers/ private investors/ foundations will have a much broader range of investment options and can accordingly diversify its investment portfolios and inherently de-risk it. By applying blended finance instruments, the expected returns on investment can rise (for example: 50% of a project’s required capital is invested by public funders, who do not expect financial returns. Private investors invest the other 50% capital requirements. Now the return for the private investor will double as the whole return can be allocated to them – as in this specific case the public funder does not require any return), making investments ins such projects more attractive.

- (Social) entrepreneurs have an interest in blended finance instruments and regulations as it can crowd-in additional necessary funding and more diverse investors. Such procedures may support the entire safe water sector as such and lead towards a future with growing impact.

Attracting private sector funding requires a clear shift of mindset from a grant to an investment perspective. HWTS and water kiosk business models that want to work in an investment mode need to be viable and eager to pay back investments with an interest out of its profits over time as described below. Key for this endeavor is also being able to discuss numbers and strategies with investors (see pitching investors for more information). It is crucial to make more business models economically viable in order to have feasible investment opportunities that can reach major impact.

For more information please visit IMPACTALPHA (2017) offering a variety of online courses about impact investment and blended finance.

| BOX: Business viability as precondition for investments A precondition for this investment mode is business viability understood as covering the following aspects:

|

To allow companies to prepare for blended finance, there is a variety of instruments and mechanisms in place to facilitate attracting private funds in a project or (social) enterprise through public and private investments. To improve the current situation with millions of people lacking access to safe water it is important governments and the private sector do invest in infrastructure and facilitate access to investments for innovative enterprises in the safe water sector (KALKER & TRÉMOLET, 2016). This can be done in form of providing access to de-risking mechanisms by international organisations, development banks and official development assistance (ODA) and by creating an enabling environment for investment, legal frameworks that regulate investor protection within a country and permitting blended finance as a financial instrument. In parallel there are opportunities for governments to set up water-related investment funds in collaboration with World Bank, IFC, or EU bodies for instance the EU-Africa infrastructure fund. Interesting also to consider:

- “5 ways to make blended finance work”, a WEF publication from 2017, and consider also an overview on funding instruments from Consultative Group to Assist the Poor.

- The Convergence - Resource Centre offers a platform that connects and supports private, public, and philanthropic investors for blended finance deals in emerging and frontier markets with social enterprises. In addition it offers case studies and research papers around the specific topic.

Below, blended finance instruments for (1) SMEs, (2) investors and (3) de-risking are explained (PEREIRA, 2017; STRUEWER & MOEHRLE, 2015; GIIN, 2013; GIIN, 2016):

1. Direct instruments for small and medium enterprises (SMEs)

- Blending framework of the European Union offering investment grants, technical assistance, risk capital and de-risking instruments

- Blended finance instruments specifically for SMEs in Asian countries

- SMEs in African countries can benefit from European investment facilities

- SMEs in Latin America Europeaid instruments

2. Instruments to support investors in emerging markets

- Investment grants : Investment grants can cover specific costs and activities in order to decrease overall project costs while increasing the enterprises chances of viability. Such grants are usually part of a larger package and are used mostly to purchase or upgrade existing fixed capital, such as tools or facilities. Some specific forms, such as interest rate subsidies, can help lower the costs of finance that are resulting from underdeveloped local financial markets. Such investment grants are offered by different institutions such as foundations supporting start-ups and small businesses as well as by development agencies.

- Investment loans: Investment loans are usually provided by public institutions to de-risk private investments. The loans are usually given out for a limited time and at low interest. Depending on the loan provider, specific costs and activities can be funded o and companies meeting specific requirements can apply for it. An example is the start-up fund from the Swiss State Secretariat for Economic Affairs (SECO), offering loans to companies with at least one Swiss citizen implicated. Other suppliers of investment loans can be banks, the World Bank or programs of development agencies offering different sizes of loans.

- Equity investment: Equity investors take a percentage of the ownership of the enterprise or project. The money is then used to start the project and to demonstrate viability. This measure can leverage and provide comfort for investors (for example, investors could see the other party investment as a guarantee of the quality of the project and/or as a reduction in risk as the host government might interfere). For instance, the public sector buys 20 percent of a company in the hope that private investors will see this as a sign of confidence and follow suit. Help for such investments can be found from investment banks, business angels, investment networks, consulting companies and specialized lawyers.

3. Provision of de-risking opportunities to attract private investments

- Technical assistance: Technical assistance can have a variety of implications. It can lower the high transaction costs and risks for investors linked to new projects or scaling business activities to new areas. It can also help improve the quality of business activities or the project. This can for example be achieved by funding impact studies, thus increasing the likelihood of success. For instance, a study of the potential increase in project productivity with the provision of a new filling machine to attract private investors as CapEx will be lower. Such technical assistance is offered by country programs of the World Bank, as well as different ODA institutions, chambers of commerce, NGOs and foundations. One example is the Boost Africa initiative, a joint project between the European Investment Bank and the African Development Bank started in 2017, providing de-risking and technical assistance via intermediaries. For contact information, please visit European Investment Bank. For business development expertise in the water sector please visit Aqua for All, cewas and Antenna Foundation.

- Loan guarantees: Loan guarantees aim to protect investors against losses and/or improve the conditions of potential return (government of philanthropic guarantees reduce borrowing costs). For example investments in new equipment attract private investors, but they still perceive the risk to invest as too high, so the public sector provides a guarantee of payment should the expected increase of productivity not materialise. Different institutions such as specific funds, governments and ODA agencies, provide loan guarantees.

- Structured finance: first loss piece: Structured finance can reduce or even absorb risks by making the public funder to take losses that may occur if the project is not viable during a certain period of time. For instance, a project fails and does not leave enough capital for all the investors to be paid back. The ‘first loss’ investors (in this case, the public entity) lose their money first (GIIN, 2013).

- Investment de-risking: Investment de-risking is the protection of investments against non-commercial risks and also improvement of access to funding sources and financial terms and conditions. Investment de-risking is for example provided by the MIGA (Multilateral Investment Guarantee Agency of the World Bank). Its mandate is to promote foreign direct investment in developing countries by providing guarantees (political risk insurance, credit enhancement etc. see here) to investors and lenders. More information about MIGA’s de-risking instruments can be found here and here.

In the next paragraph the concept of Social Impact Incentives, a specific form of blended finance is described to provide practical insights on how blended finance implementation can work in practice.

Subscribe here to the new Sanitation and Water Entrepreneurship Pact (SWEP) newsletter. SWEP is a network of organizations joining hands to help entrepreneurs design and develop lasting water and sanitation businesses.

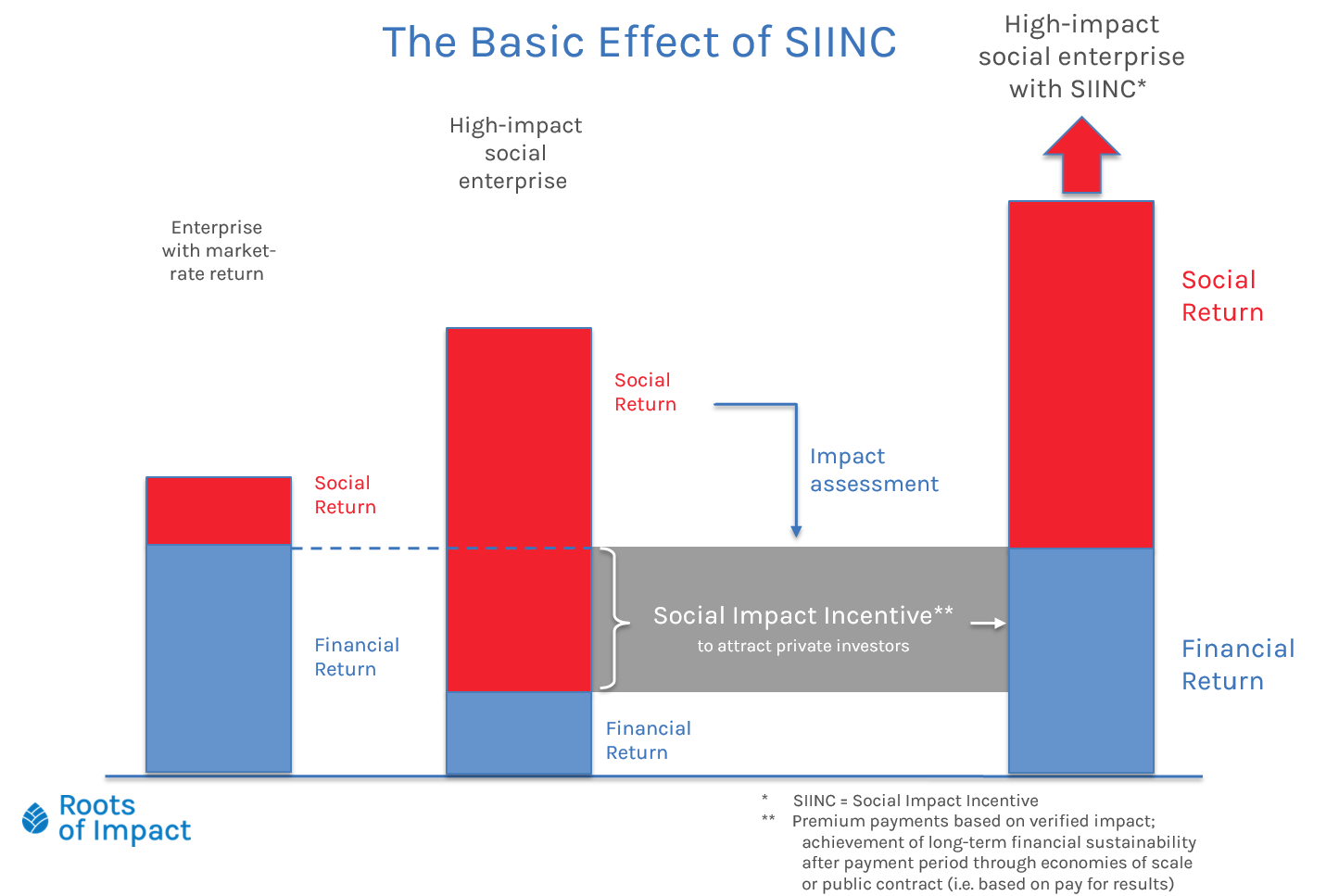

Social impact incentive is a specific form of blended finance. The concept advocates public funders and philanthropists to pay premiums/grants to social enterprises for their social impact creation. Meanwhile this initial financial support will lead to an increased viability of the company and attract (more) investors due to higher financial returns implied by the respective interventions.

Swiss Development Cooperation (SDC) and Roots of Impact co-created the concept of Social Impact Incentive (SIINC) in 2015.

The figure above illustrates the rationale behind the SIINC concept: a social-impact incentive investor (public funder, philanthropist) pays premiums for a quantifiable social impact (e.g. delivering safe water and mitigating the occurrence of waterborne diseases) thus raising the revenues of the social enterprise by adding them to the enterprise’s regular revenues. These initial payments have a catalytic effect on all parties involved: they accelerate the social enterprise’s process of achieving long-term financial viability as the profitability of the social business becomes closer to that of the market rate, it attracts capital investors who are “mostly or also” interested in financial return, which is reflected in strong, ongoing social and financial returns on the resources that they invested (PRICE, 2016).

Being financially viable, the social enterprise immediately becomes a more attractive investment opportunity. Also, there is no longer a pre-defined investor in the model: The enterprise can freely engage with investors in the market, as the necessary profitability is in place. This allows the business to be more flexible, and it increases its sustainability, resulting in ongoing, increased impact for society. (ROOTS OF IMPACT, 2016).

With this strategy, the concept aims to attract (more) investors who are motivated by both financial and social returns. In the mid-term, this practice shall more and more innovative social enterprises allow reaching scale.

- With the concept of SIINC public funders and philanthropists have additional opportunities ahead to transfer their available funds in a sustainable manner and receive in return the achieved outcome. On top of that, the funding enables the social enterprise to attract social impact investors that have been neglecting the enterprise so far due to lack of financial viability.

- For social entrepreneurs SIINC implies new opportunities to reach viability. Therefore, the company’s outcome must be measured and translated into investor’s language to attract additional investments. This leverages the investment and ensures the scalability of the social enterprise in line with its mission.

The practical example of SOIL HAITI provides additional hands-on insights of how blended finance can work in practice.

Annual Impact Investor Survey 2016

Achieving universal access to water and sanitation by 2030 – how can blended finance help?

Blended Finance Vol. 1: A Primer for Development Finance and Philanthropic Funders

Social Impact Incentives Aim to Tilt Businesses toward the Needs of the Poor

Social Impact Incentives (Siinc) - Enabling High-Impact Social Enterprises to Improve Profitability and Reach Scale

5 ways to make blended finance work

Blended Finance: What it is, how it works and how it is used

Blending loans and grants: to blend or not to blend?

Catalytic first-loss Capital

Untangling Misconceptions about Blended Finance

NexThought Monday: Pay for Success: With an Important Twist

Financing WASH: how to increase funds for the sector while reducing inequities

This Position Paper addresses three key issues that are receiving limited attention in the water and sanitation sector discussions on (blended) finance:

- The lack of finance for strengthening the enabling environment

- The untapped use of micro and blended finance

- The inequities in allocation of finance in the sector

Achieving Universal Access to Water and Achieving Universal Access to Water and Sanitation by 2030: The Role of Blended Finance

This article discusses the needs of innovative finance instruments to reach people with access to safe water and sanitation. To achieve the Sustainable Development Goals (SDG) 6 by 2030 over USD 1.7 trillion have to be invested. Existing funding falls far short of this amount; countries may have to increase their investment in the water and sanitation sectors by up to four times in order to meet the SDGs. Where is this financing going to come from? Blended finance could play a significant role here.

LEIGLAND, J. ; TRÉMOLET, S. ; IKEDA, J. (2016): Achieving Universal Access to Water and Achieving Universal Access to Water and Sanitation by 2030: The Role of Blended Finance. URL [Accessed: 20.04.2018] PDFBlended finance: Understanding its potential for Agenda 2030

This publication discusses different blended finance approaches and investigates the developments of private sector investments as a result of blended finance. In addition are recommendations given how to foster use and implementation of blended finance instruments and measures in practice.

TEW, R. CAIO, C. (2016): Blended finance: Understanding its potential for Agenda 2030. Bristol : Development Initiatives URL [Accessed: 20.04.2018] PDFBlended Finance – WASH Talk (video)

In this seventh episode of IRC's podcast series WASH Talk, hosts Andy Narracott and Patrick Moriarty ask Sophie Trémolet of the World Bank how blended finance can close the financial gap needed to meet Sustainable Development Goal (SDG) 6. The gap is an estimated USD 114 billion per year for construction and 1.5 times that amount for maintenance. In the podcast she explains to a non-economist audience what the challenges and opportunities are when using blended finance.

TRÉMOLET, S. (2017): Blended Finance – WASH Talk (video). The Hague: IRC URL [Accessed: 20.04.2018]Uncharted Waters – Blending Value and Values for social impact through the SDGs: Business Call to Action

Redesigning Development Finance

Social Impact Incentives (SIINC)

Roots of impact: Roots of impacts builds the market for impact investing. Social impact incentives (siinc) is a funding instrument that rewards high-impact enterprises with premium payments for achieving social impact.